The Secret to Steer Clear of Million-Dollar Fraud? Verified Tax Data Published April 30, 2021

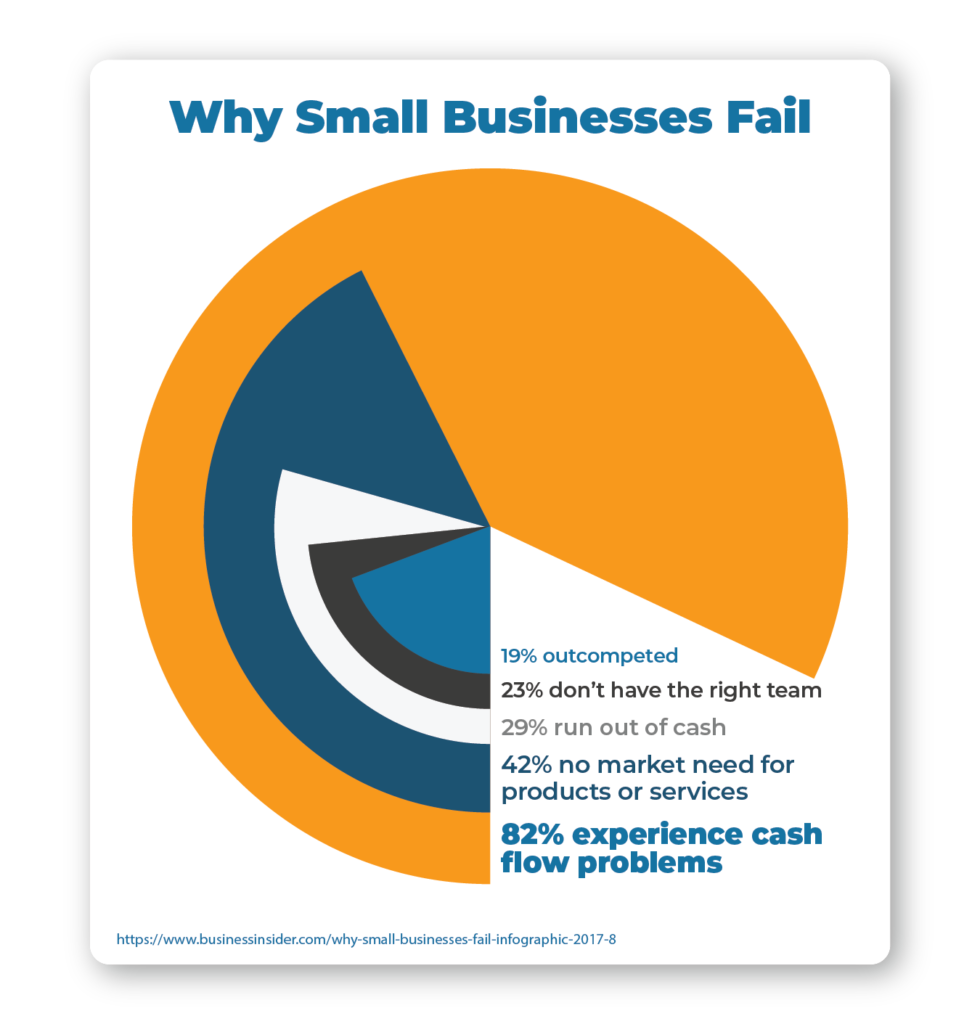

When small businesses get desperate for cash, the inclination to commit fraud increases. Where can they cut costs? Not with their employees, who would leave if wages were slashed or unpaid. There’s only so much that penny-pinching can do. A lightbulb flashes: if they fudged the numbers a bit, just this once, they might make it through to the next cash flow windfall.

In normal times, cash flow is a challenge for businesses — the average business has just 27 days of cash on hand — and these aren’t normal times. We’re in the midst of a global crisis that has significantly impacted small business liquidity and access to capital sources.

When businesses hit a cash crunch, desperation kicks in, making fraudulent activity that much more attractive. Business owners in circumstances like these might decide to produce an invoice slightly early or with doctored dates and submit it to their factor to get a payment just a bit earlier than they should. However, this kind of behavior can catch up to them if the cash flow problem doesn’t resolve itself — that’s when desperation kicks in and the propensity to commit deeper fraud ramps up even more.

Of course, not every case of fraud is circumstantial – there are always bad actors looking for a quick buck. Recently, a business owner from Sweetwater, Texas pled guilty to a $12.3 million wire fraud scheme involving fabricated invoices and assumed identities. The IRS, Postal Service, and FBI stepped in to investigate, but not before 38 fictitious invoices worth millions of dollars were generated, sold to the factoring company, Navarone Capital, LLC, and paid to Stewart Kile Williams of AZS Trenching.

Lenders could easily find themselves at risk for both circumstantial and premeditated fraud from small businesses, but they can protect their collateral long before the IRS makes a move by going to the source itself, catching the fraud before even doing business.

With verified tax data directly from the IRS, the factor could confirm that the business is actually making tax deposits and filing returns. One red flag: if there’s a discrepancy between what’s on file with the IRS versus the records available at the Secretary of State’s office, a shell company might be in play. Tax Guard goes beyond public record sources and accesses the borrower’s federal tax records to provide a holistic view of the business operations, giving lenders the information they need to mitigate risk.

With verified tax data, factors can save millions of dollars in avoiding funding fraudulent businesses and conserving the valuable resources required to resolve the fallout. In a case like the Sweetwater, Texas factoring fraud, that kind of business revenue and invoice volume calls for a significant number of employees. Fraudulent businesses aren’t going through the process of filing employer’s quarterly tax returns, nor are they going to make tax deposits on fake employees; Tax Guard can verify if the employee tax deposits and tax return data match up to the volume of business activity, sending up a red flag if the equation doesn’t add up. A simple view of verified business tax data is a valuable tool to thwart off fraudsters.

For more information on how to get ahead of fraud in your portfolio, contact us for a demo today.