NO UPFRONT COMMITMENTS

- No License Fees

- No Initial/Annual Contract

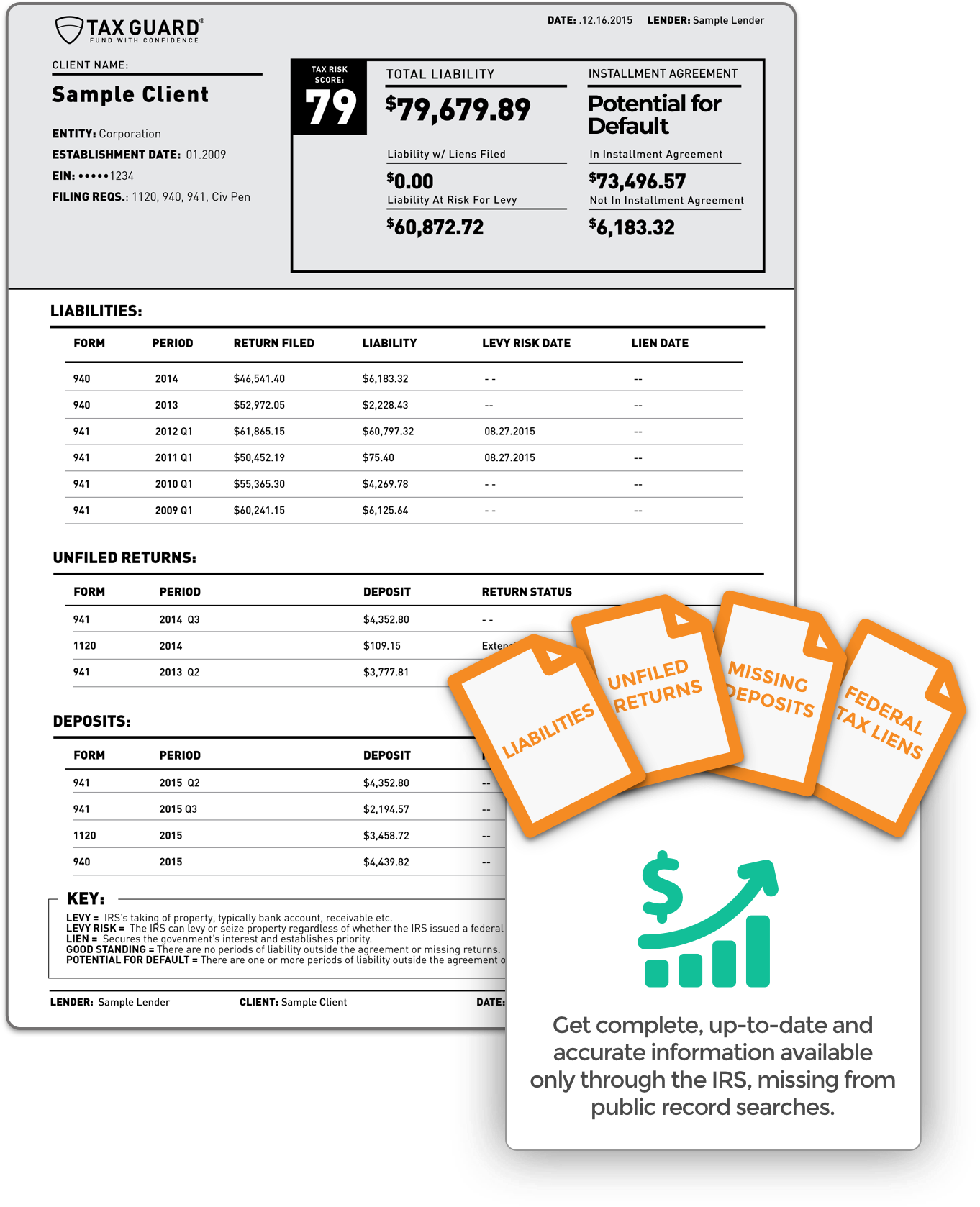

Foresee exposure and mitigate risks throughout your client relationships with Tax Guard’s real-time reports and resolution services.

At-a-glance reports show your clients' tax history and risk.

Tax Guard reports provide up to 10 years of history on client tax compliance including:

• Outstanding liabilities

• Missing tax returns

• Tax deposit verification

• Federal tax lien filings

Let us deal with the IRS while you focus on lending. One concise report allows you to make confident credit decisions with complete and reliable federal tax compliance data.

Early knowledge of potential risk allows you to mitigate tax issues, and predict cash flow problems or financial instability before the IRS takes action.

It is extremely important to confirm that your client’s information matches the IRS’s records; otherwise, your due diligence may be incomplete - and may even be on the wrong company.

This proprietary score quickly assesses the IRS’s threat to your collateral, and should be a key element of your due diligence. Our subject matter experts can consult with you and recommend solutions based on your specific risk tolerance.

Drill down on your client’s tax debts regardless of whether a tax lien is filed. Tax Guard reports show debts by IRS tax form and period as well as lien filing and levy risk dates, so you have a detailed view of your client’s current tax situation.

Prevent fraud by verifying whether your client’s tax return was submitted to and then processed by the IRS. The filing of missing returns could result in a significant liability, thereby impacting the funding relationship

The status of your client’s recent tax deposits - amount, timing, etc. - determines compliance and is a strong indicator of cash flow. Get the whole picture so you can make a confident funding decision and help your client address any issues.

Pre-funding reports are available in as little as four hours, to allow fast turnaround time from application to funding.

Supercharge your underwriting by utilizing Tax Guard's seamless API in your current workflow.

Monitor your clients to protect your assets by staying in first position when using accounts receivable or inventory as collateral.

Proactive, comprehensive information sourced directly from the IRS on a monthly basis for each monitored client.

Triggered alerts notify you when your client’s account has changed with the IRS so you can preemptively manage your risks.

With ongoing client monitoring, we have a proven success record of preventing loss, helping lenders improve their overall portfolio health.

Let our experienced team resolve your clients' tax problems so you can focus on funding.

We negotiate a payment plan your client can afford, no matter the size of the liability or extent of the issue with the IRS.

We have a successful track record of obtaining subordinations of federal tax lien. You retain priority over the IRS’s lien and protect your collateral.

You can continue to work with your valued client, secure in the knowledge that your interests are safe from the IRS.

Join our community and subscribe to Tax Guard's Newsletter to receive great tax-related

content for commercial lenders delivered right to your inbox.