100% of Tax Liens Have Been Stripped from Credit Reports – Should Lenders Be Alarmed? Published April 24, 2018

The shock waves of credit bureaus failing to provide tax lien data continues to resonate throughout the world of lenders.

The shock waves of credit bureaus failing to provide tax lien data continues to resonate throughout the world of lenders.

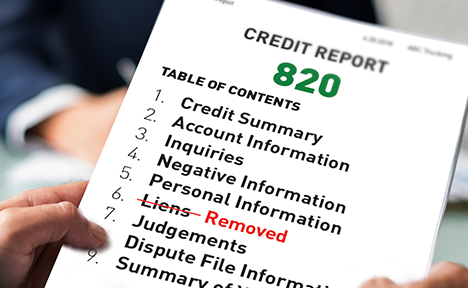

Just last week, beginning April 16, 2018, the big three nationwide credit reporting agencies (Equifax, TransUnion, and Experian) announced that they will stop reporting tax lien data and remove all tax liens from credit reports, a move according to The Wall Street Journal, “will make some risky borrowers appear more creditworthy and increase the chance they will get new loans from banks.”

Ouch. If there’s one thing lenders are not interested in is taking on more risks.

How Did We Get Here?

In 2017, we reported that as a result of insufficient quality controls and multiple Attorney General lawsuits, the three major credit reporting agencies, would be deleting approximately 50-60 percent of tax lien data from their credit reports.

Over the past year, the bureaus have determined that remaining in compliance with the procedures required to prove the accuracy of the tax lien data was unsustainable. Essentially, the costs and risks of violations and threats of additional lawsuits proved to be too high.

According to a TransUnion customer announcement on this latest development, it was noted, “Since [July], our ongoing review and monitoring of tax lien data transmitted by our third party vendor has led TransUnion to decide to cease reporting tax lien data and to remove all remaining tax liens from our consumer credit reporting database in order to ensure compliance with the enhanced standards of the NCAP and to resolve pending litigation.” Experian and Equifax followed suit, as well.

So now we have a current landscape where 100% of past, present, and future tax lien data will no longer find its way to a credit report.

What’s the Impact for Lenders and Borrowers?

Without a crystal ball it’s challenging to determine the specific impact that deleting a tax lien from a credit report will be. For consumers with a level of sub-par credit, one would have to suppose that access to credit will be improved. As for lenders, according to Wall Street Journal, “the move creates a blind spot for risk.” At the end of the day, this shift in reporting doesn’t bode well either for borrowers or lenders given that stability and predictability are the cornerstone for quality loans for lenders and to maintain competitive pricing for borrowers.

From a customer-facing perspective, the credit reporting agencies are attempting to deflect the impacts of the situation on lenders. The Consumer Data Industry Association, a trade association that lobbies on behalf of the credit reporting agencies, put out a statement to suggest that these changes, “show only modest credit scoring impacts.”

While this is an understandable tactic to keep their customers satisfied and their prediction models intact, it’s fundamentally hard to digest the notion that someone presents essentially the same credit risk with or without a tax lien on their credit report. Any credit risk professional will tell you that knowledge of a tax lien changes the way risk is measured for a borrower.

The public record data companies that provide lien data to the credit reporting agencies are looking at this opportunistically to position themselves as the lone option for lenders interested in tax lien data.

However, even with the opportunity for a lender to get tax lien data elsewhere, there remains a critical gap that cannot be filled by any public record company. Lenders still don’t know if their borrowers are paying their taxes or not. Directly searching for tax liens is not a reasonable alternative and now lenders must look elsewhere to ensure that they are aware of every possible risk.

What Can Lenders Do About it?

Even though the 100% removal of tax lien data is a new development, let’s be clear on one thing–whether it’s a 10% or 100% reduction in lien data reporting, the risk of the unknown that could affect a loan’s performance remains present. The credit reporting agencies shift to a 100% removal only continues the story line and highlights what has always been a glaring risk, regardless of tax liens being reported or not.

When we talk to lenders about their creditworthiness evaluations, they’re looking to understand whether or not their borrower is in full compliance with their tax obligations. It doesn’t take sophisticated modeling to bear out that if a borrower isn’t paying their taxes they likely have a cash flow issue and are more likely to default on their loans.

The problem is that tax liens are a very poor indicator of the credit risk presented by non-payment of taxes. Lenders should be focused on the shadow tax debts that are typically unseen by lenders.

Simply put, tax liens are not filed every time an outstanding tax debt is assessed. Furthermore, in the cases when IRS does decide to file a lien, they show up on average 15 months after the non-payment occurs. Therefore, lenders need to know when the non-payment occurs, not years later, if ever, when a tax lien is actually filed on the public record.

This non-payment of tax debt is a shadow debt that’s become a growing problem for lenders. We’ve done over 1 million tax data reports on borrowers and have uncovered 5.2 billion in unpaid tax debts. Over 45% of these tax debts had NO tax lien filed–all hidden in the shadows, unseen in the public record.

Since we now know credit reports and public record searches for tax liens are unreliable for understanding credit risks related to non-payment of taxes, lenders must then ask themselves, “what percentage of their borrowers have this shadow debt lurking in their portfolios?”

There’s only one way to find out, search for tax debts, not tax liens.

Want to learn how to obtain the tax debt information of your prospective and current borrowers? Please schedule your demo today or contact us directly to learn how Tax Guard can work for you.