How to Spot a Cash Flow Problem Before it Hits Published July 22, 2021

Imagine lending money to a company and not knowing if they have substantial cash flow issues in the form of hidden federal tax debts. Would you be shocked if we told you we see bankers doing this all the time? And it costs them millions.

Why? Simple: they’re not checking all the boxes.

For decades, bankers have conducted their typical due diligence when assessing the credit risks associated with a potential borrower — tax returns, bank statements, and so forth. But the reality is, lenders have ignored one of the most significant credit risks that are often hidden from the balance sheet: federal payroll taxes.

A large segment of C&I lending falls under the government guaranteed SBA lending program. Loans guaranteed through traditional SBA lending programs exceeded $28 BN in 2020 alone — Lenders and the federal government can’t afford to lend money to businesses with misleading financial assessments, thereby putting taxpayer dollars in the hands of failing businesses. Commercial lenders of all types need to know with 100% certainty if a business has been paying their payroll taxes on time and in full — as failure to do so is one of the largest indicators that a business has trouble maintaining healthy cash flow.

Businesses Choose to Short Pay their Payroll Tax Deposits when they have Cash Flow Problems. How does this happen?

For more than 20% of the companies that have outstanding payroll tax debts owed to the federal government, there’s no public record of a tax lien filed. These businesses will not show up on a credit report or any public record search for non-payment of their tax obligations. Public records only track when a federal tax lien was filed, NOT when a business makes a choice to not pay their payroll tax deposits.

For the other 80%, the information that lenders receive from the IRS is at best, many months behind and at worst, inaccurate. This information can drastically alter how lenders view the financial health of a business. When lenders are analyzing credit risks, they’ll often use the antiquated process of searching public records for federal tax liens to determine if the business is paying its tax obligations.

Suppose you only ignored a company’s stock performance for the last 16 months (including the entire pandemic) — that’s effectively what lenders are doing when they actually find a public record of a tax lien.. A run-of-the-mill search will only show the amount owed on the lien when the lien was filed. Depending on when the search is done, the debt amount could actually be much higher. A simple search provides an incomplete and often inadequate picture to the underwriter.

Payroll tax is the most predictable indicator of cash flow problems.

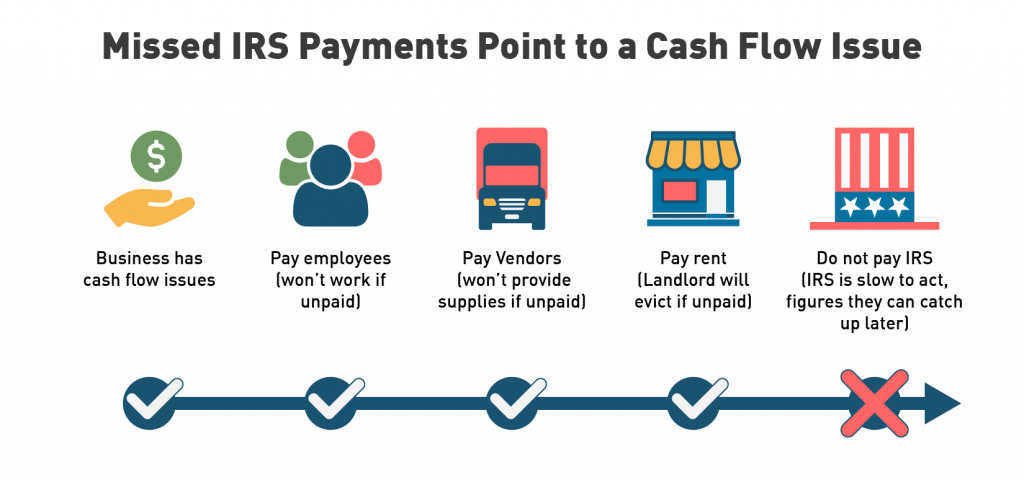

When a company starts to have cash flow problems, as many have in the past year, often the first expense they ignore is the IRS, because it’s the last one to have consequences.

Think of it this way: if a business doesn’t pay their employees, they don’t show up. If vendors don’t get paid, they stop servicing. If you’re a small business trying to cut costs to secure your future in a post-pandemic world, the repercussions for not paying the government are the easiest to push aside. It’s a temporary band-aid that will be resolved in the near future, right? Maybe, but the problem is the correlation that exists between the moment companies stop paying their payroll taxes and the ones who eventually default on their loans. Tax Guard’s data shows that companies who see a 10-15% decrease in their payroll tax deposits have nearly a 50% chance of defaulting. The emergence of payroll tax compliance insight proves why tax data is becoming one of the most predictable indicators of cash flow issues.

For lenders, it’s not an intentional misstep. Many believe they’re following the proper procedure with a public records search for tax liens — but this type of search will show an incomplete picture 20% of the time — it’s now possible to go deeper and gain more useful insights into the health of a borrower. With the increasing scrutiny placed on cash flow as small businesses move towards recovery, unpaid tax debts should be a red flag for bankers to review thoroughly.

Thankfully, we can see the light at the end of the seemingly endless COVID-19 tunnel, and the picture for small businesses seems a bit brighter. On the heels of a $1.9 trillion COVID-19 relief initiative, expect consumers and small businesses to start spending again and applying for loans that can help sustain their future.

The Bottom Line

History tells us that for lenders it will keep coming back to unpaid payroll taxes (as well as other off-balance sheet liabilities). It’s an issue that we’ve seen come back to haunt lenders over and over again. There’s no doubt that as small businesses begin to make their rebound, uncovering hidden tax debts will become an increasingly crucial data point to identify and monitor.