Recognizing the Signs of Loan Fraud with Tax Return Transcripts Published August 19, 2022

Lenders know that the benefits of applying tech-driven solutions to the lending and underwriting process are manifold. However, as financial services become increasingly digital, online processes also tend to attract a multitude of tech-savvy bad actors who artificially inflate their incomes by creating fake tax returns, landing sizable loans they may not have the ability to pay back–or even worse, have no intention of paying back.

LexisNexis reports that small business lending fraud has increased 6.9% since 2020—and is only expected to increase over the coming year. Exclusive, up-to-date tax information allows lenders to verify data quickly, making it easy to confidently separate legitimate, qualified small businesses from potential fraudsters. The process is as easy as reconciling the reported income on the tax return given to you, the lender, with the income that’s been recorded on the borrower’s official tax return filed with the IRS.

Fake Tax Forms Are Easy to Find, Harder to Detect

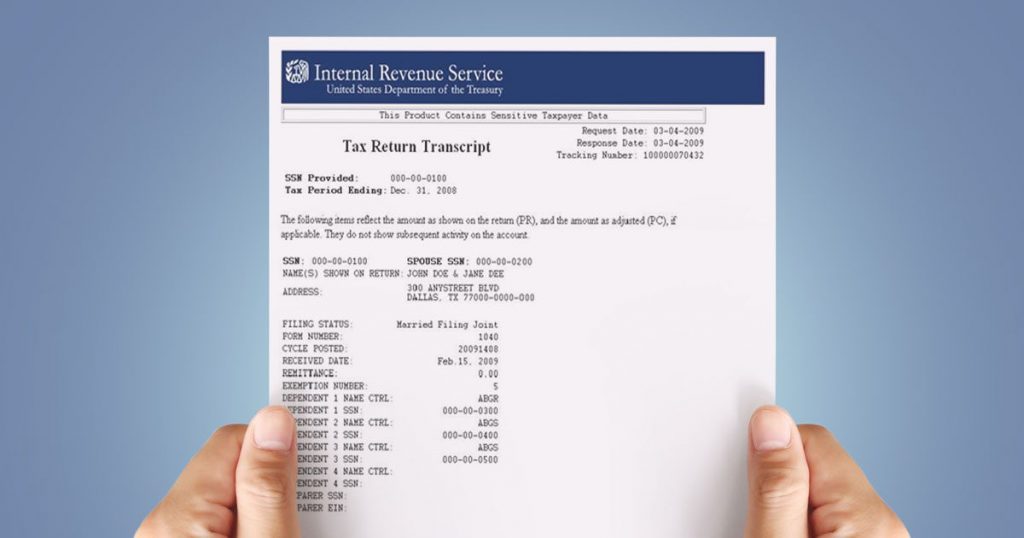

IRS income tax returns have long been the gold standard for lenders verifying the income and expenses of individuals and businesses looking to obtain credit. There’s a deep repository of verified data captured by the IRS from both taxpayers and 3rd parties that paint a strong picture of the loan applicant’s creditworthiness.

The challenge in this ever-changing digital environment is as follows:

How does the lender know that the tax returns provided to them are the actual tax returns processed and reviewed by the IRS?

The unfortunate truth is that it’s actually quite simple for a borrower to create fake tax returns for a loan application. While of course, mistakes and typos happen, some individuals will inevitably seek to provide false information to lenders and purposefully inflate their incomes in order to land a larger loan than they’re entitled to.

A borrower can easily alter a real tax return PDF received from IRS.gov, and simply add an extra zero or two to their actual recorded income. While they’re advertised as joke forms, there’s nothing funny about the myriad fake tax form generators that a quick internet search reveals are hidden in plain sight. Because fraudulent forms are so easily accessed via an internet search, this signifies that they’re commonly requested and used. These forms are strategically filled out to appear as though they are professionally prepared and connected to a large bank, loan service, and/or mortgage company with which the taxpayer may have a current relationship.

Regardless of a form’s origin and the borrower’s awareness that fraud is being perpetrated, lenders that receive and process fake forms as part of a lending agreement can face serious repercussions.

Protect Yourself From Getting Burned By Falsified Tax Forms

Economic uncertainty stemming from the pandemic has led to an increased amount of fraudulent tax documents spotted in loan applications. In one nightmare scenario, a Texas man submitted falsified federal tax filings in order to bolster fifteen fraudulent applications to eight SBA-approved lenders, ultimately landing $24.8 million in PPP loans for businesses he completely fabricated. Lenders and underwriters who take applications at face value and only verify information against what can be found in a public record search are at risk of being duped.

To ensure that the process of verifying business and individual identity is as accurate as possible, consider requiring information not normally included in the verification process, such as personal and professional tax data or a driver’s license. Avoid wasted time verifying income information with a public record search just to feel unsure about a loan approval— this gums up the loan application process, making it difficult for honest small businesses to get the funds they desperately need in a timely manner.

There’s really only one source of truth when it comes to income verification by way of tax data–the IRS. Lenders must verify borrower-provided tax returns with the transcribed data from the returns in the IRS database. There’s no substitute to ensure that lenders are making a confident credit decision with verified tax data.

Tax Guard can verify identities and provide borrower information directly from the IRS instantly with our identity verification tool, and can get you the verified tax return transcripts you need in as little as four hours.