Industries Served

Get a long-reaching view into your clients’ tax compliance.

Get a long-reaching view into your clients’ tax compliance.

Download and find out how Tax Guard's solutions can serve your industry.

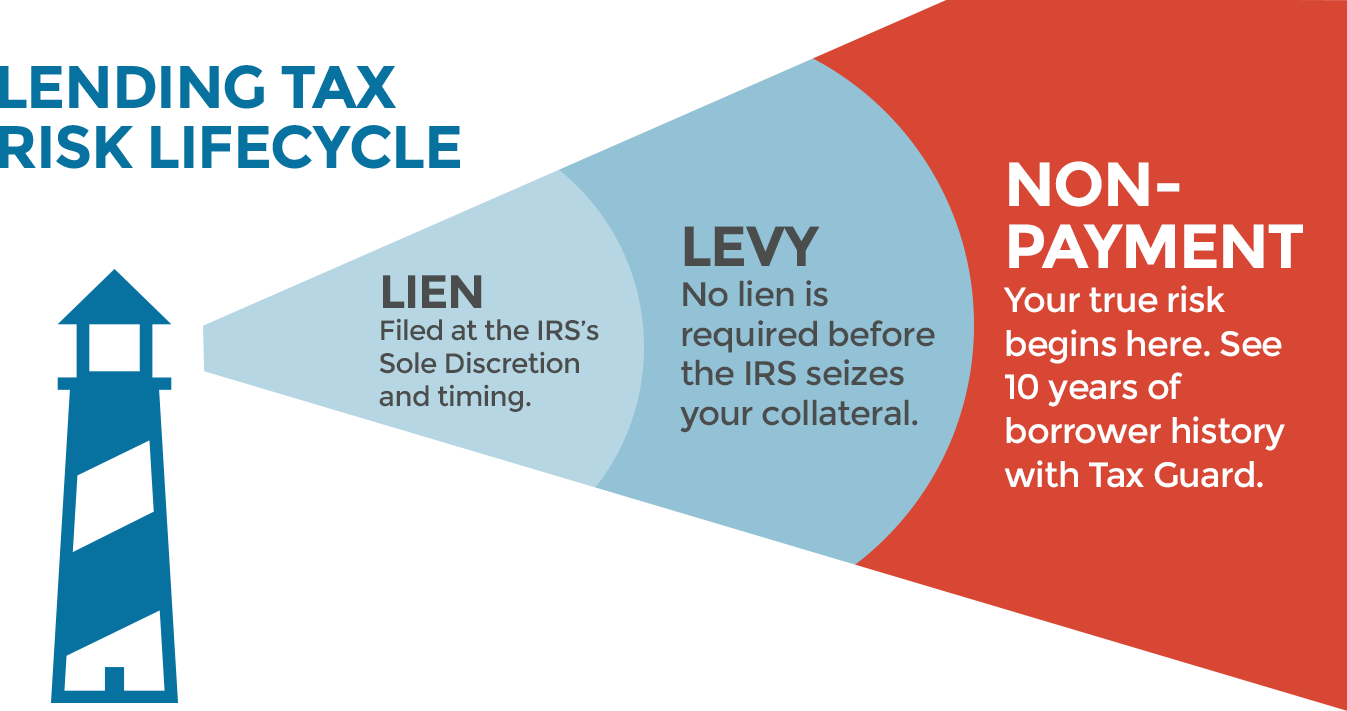

Safeguard your A/R collateral and have more time to proactively address tax risks.

Download PDFReceive alerts about impending IRS levies before they happen.

Download PDFObtain same-day tax return transcripts and avoid rejections.

Download PDFProtect your C&I loans and A/R collateral by assessing creditworthiness.

Download PDFIdentify client tax debts issues that could lead to a default

Learn More

Join our community and subscribe to Tax Guard's Newsletter to receive great tax-related

content for commercial lenders delivered right to your inbox.