The Secret to Steer Clear of Million-Dollar Fraud?…

When small businesses get desperate for cash, the inclination to commit fraud increases. Where can they cut costs? Not with their employees, who would leave if wages were slashed or …

The latest industry news, IRS changes, commercial lending trends, and Tax Guard updates.

When small businesses get desperate for cash, the inclination to commit fraud increases. Where can they cut costs? Not with their employees, who would leave if wages were slashed or …

Tax Guard compared payroll tax deposit data for PPP recipients and non-recipients in order to assess how the PPP could impact credit risks. See our infographic to find out what we discovered.

Commercial lending has certainly seen its share of ups and downs this year, but arguably none have been more impacted than government-guaranteed lenders. Read on to learn how they’re navigating this lending rollercoaster ride.

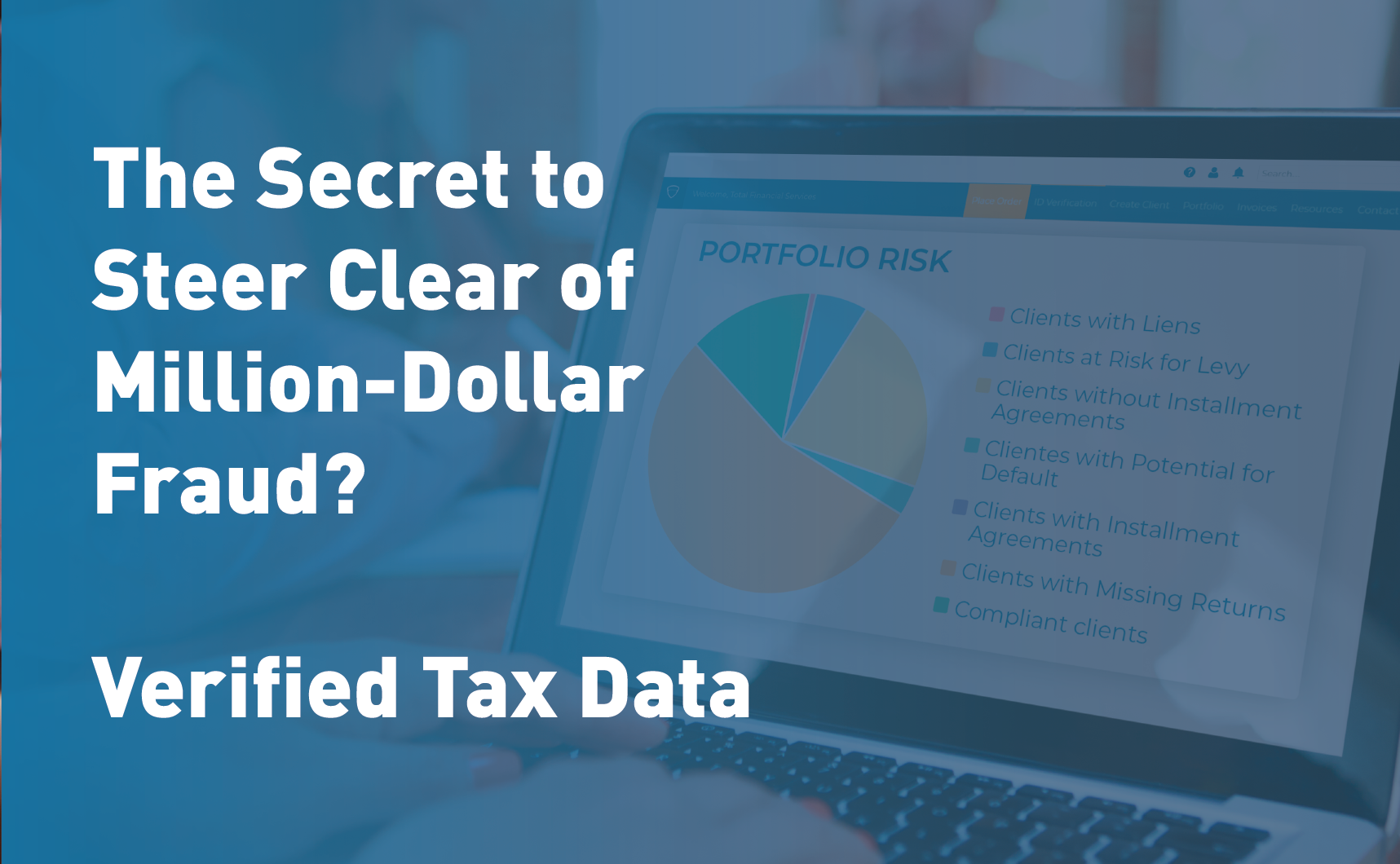

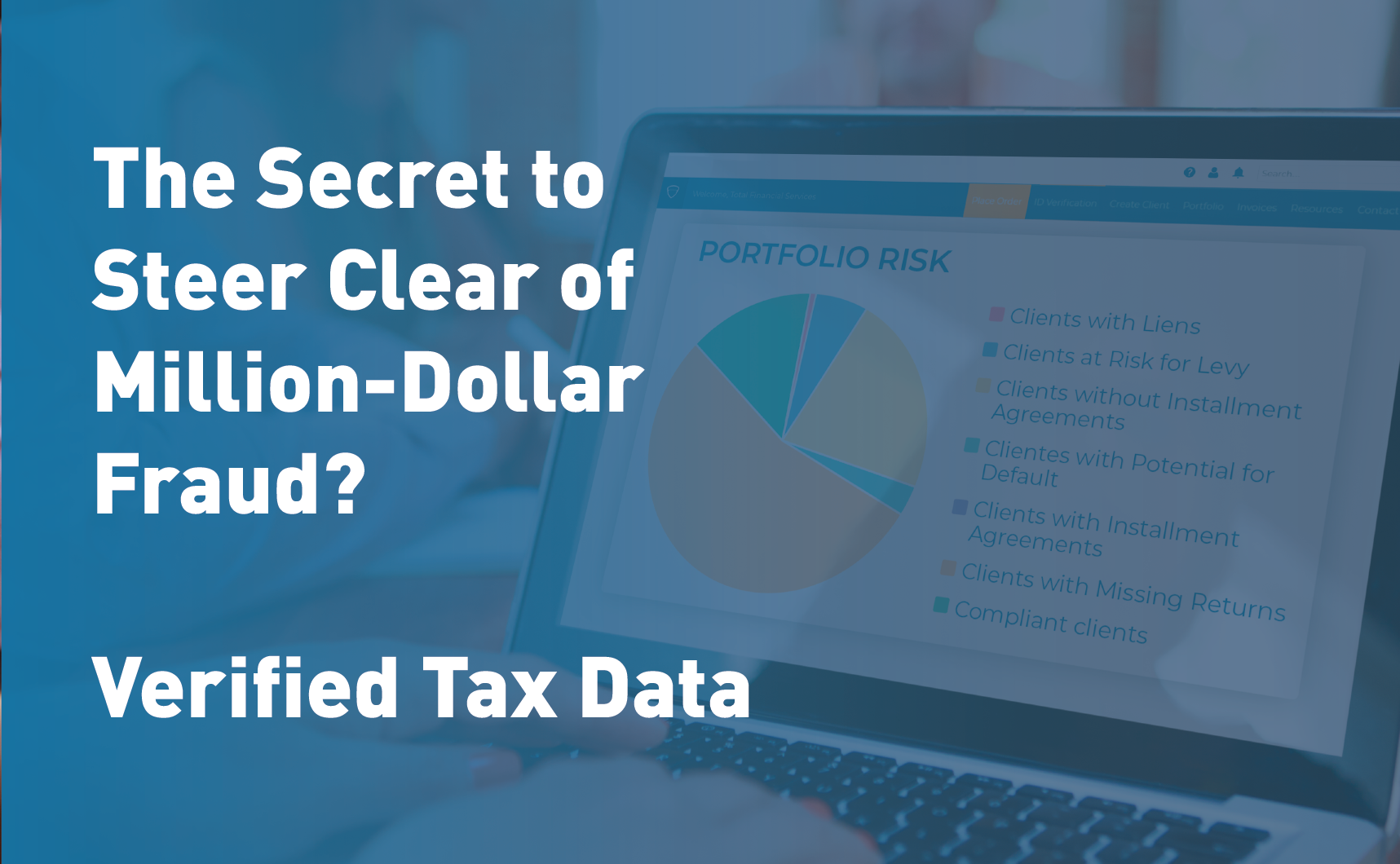

Synthetic identity fraud has always been a significant concern for commercial lenders, but the era of COVID-19 has increased those concerns considerably. The increase in digital transactions and, for some, …

Welcome to the Tax Guard quarterly product update! Check out the Q2 highlights from our Product and Engineering Teams.

We hope this blog will help you cut through the noise and get to the facts regarding IRS changes and the Senate Stimulus Plan.

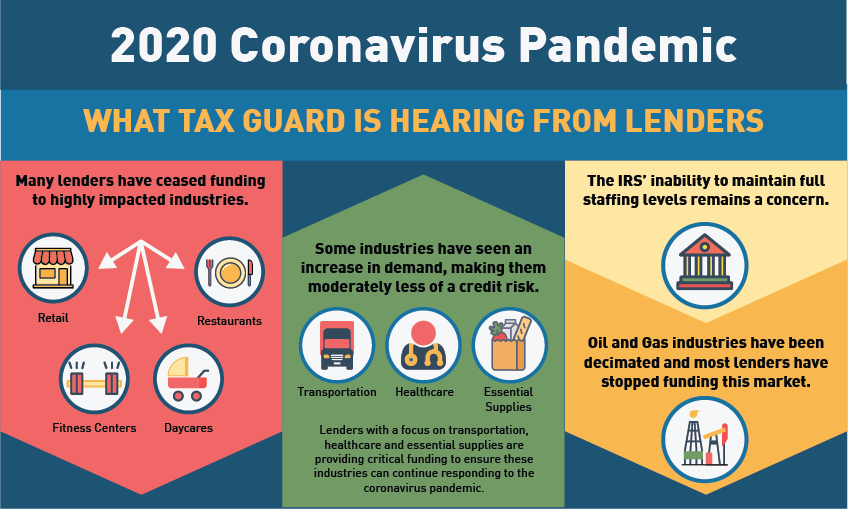

We compiled information from Tax Guard customers and industry surveys to provide you a snapshot of the lending industry amidst the coronavirus pandemic.

Join our community and subscribe to Tax Guard's Newsletter to receive great tax-related

content for commercial lenders delivered right to your inbox.