Navigating IRS Tax Forms, A Lender’s Guide

A lender’s guide to navigating the most common IRS tax forms requested on the Form 8821.

The latest industry news, IRS changes, commercial lending trends, and Tax Guard updates.

A lender’s guide to navigating the most common IRS tax forms requested on the Form 8821.

TAB Bank was utilizing an internal process for managing IRS 8821 forms, collecting IRS information on prospective clients, and ongoing credit monitoring. Managing all of these activities internally generated two key issues for TAB. Read more to learn what they were and how Tax Guard helped make the TAB partnership a success.

Recently, many small businesses with thin credit profiles have needed funding as soon as possible to survive. BayFirst National Bank was looking to rise to the occasion and confidently offer rapid assistance to as many borrowers as possible. Read more to learn how they reached this goal with the help of Tax Guard.

Since 2021, the IRS has allowed for e-signatures on Form 8821, but there’s more than meets the eye. Read on to learn more about how authenticating a signer is MUCH harder then you might think.

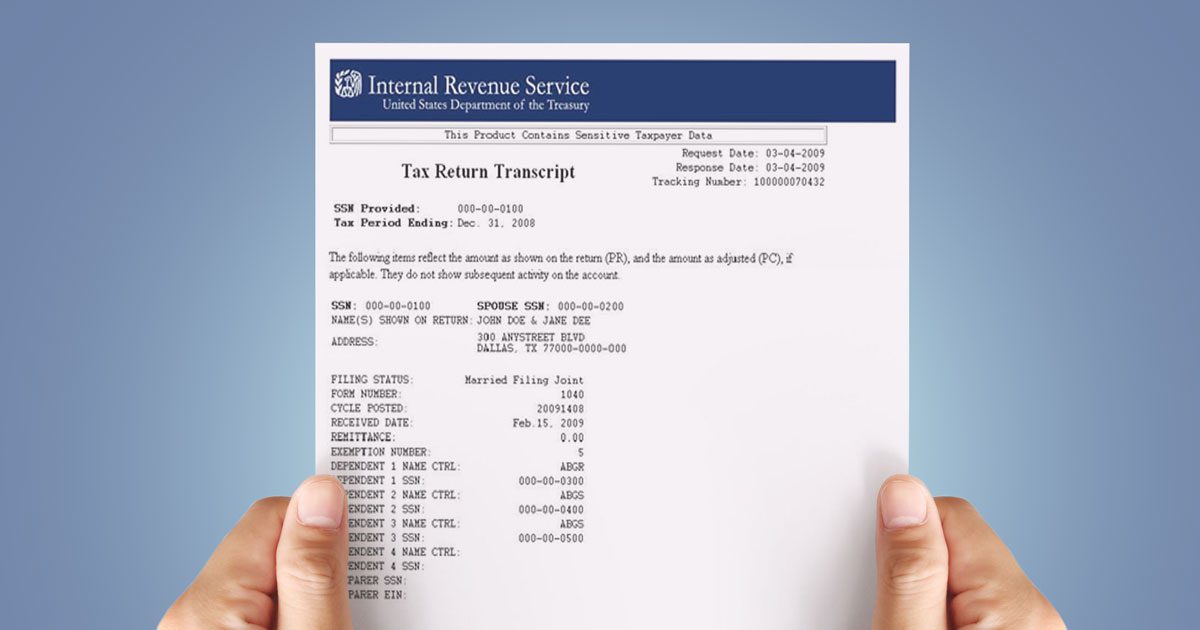

As a lender, do you know what really happens when you file a tax return transcript request with the IRS for one of your borrowers? It’s quite an adventure. Read on to discover how lenders and the IRS deal with the Form 4506-C vs. Form 8821, and to see which one has optimal results.

If you’ve ever embarked on completing the IRS Form 4506-C with a borrower, you’ve probably found yourself wishing there was a faster way to receive tax return transcripts and tax compliance data. We’re here with good news!

If you’ve ever embarked on completing the IRS Form 4506-C with a borrower, you’ve probably found yourself wishing there was a faster way to receive tax return transcripts and tax compliance data. We’re here with good news!

The IRS Form 8821, Tax Information Authorization, is an important tool for many lenders and their tax due diligence process. But misconceptions about Form 8821 can cost a lender a …

On July 1, 2019, The Taxpayer First Act of 2019 was signed into law, which aims to broadly redesign the Internal Revenue Service. Many lenders are potentially affected by the …

Myth 1: If no federal tax lien has been filed, my collateral is safe. Your collateral can be seized without notice. Many lenders don’t realize that the IRS doesn’t have …

This article was originally posted in Commercial Factor and focuses on the importance of Due Diligence and the IRS form 8821 and the potential problems you can encounter. When factoring a new or existing client, …

Join our community and subscribe to Tax Guard's Newsletter to receive great tax-related

content for commercial lenders delivered right to your inbox.