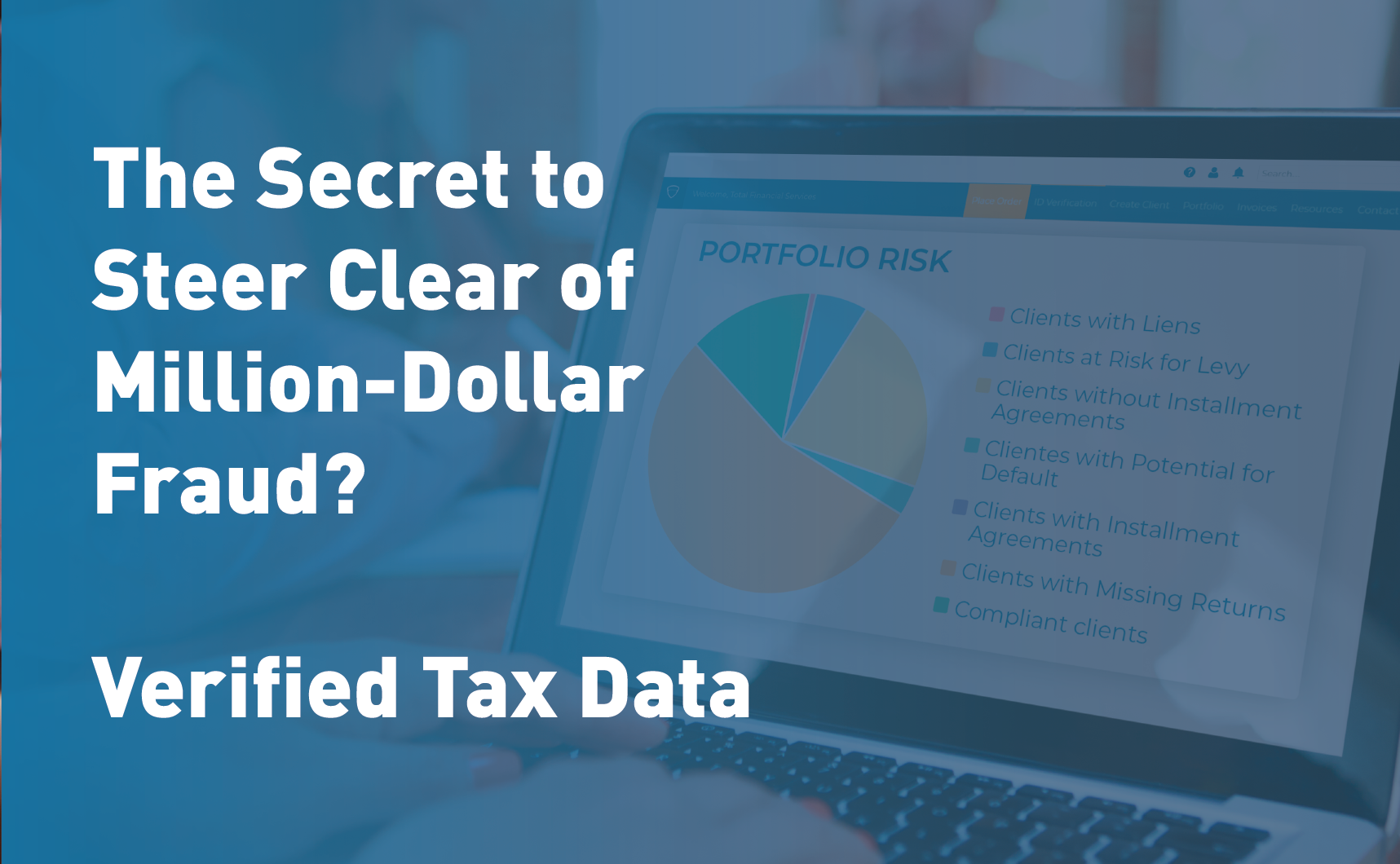

How to Fatten up Thin Small Business Credit…

With today’s economic uncertainty, lenders seeking to protect their institutions from bad loans turn down small business credit applications at a higher rate than consumer applications. What’s the answer for small business lenders? Read more to find out.